How To Make Money From Stash

Executive Summary:

Stash is a FinTech company that offers various financial products aimed at American retail investors. Examples include the ability to invest in different stocks or index funds, personal investment advice, life insurance, a debit card, and much more.

Stash makes money via subscription fees, cashback rewards, payment for order flow, and interest earned on cash.

Founded in 2015 and headquartered in New York, Stash has grown to become one of the leading personal finance applications. To that extent, Stash has raised over $300 million and is valued at $800 million.

What Is Stash & How Does It Work?

Stash is a personal finance application that offers a variety of products for investing and saving purposes.

Some of the features that Stash offers include:

- Investing in various (fractional) stocks and ETFs without any set limits

- Personalized investment advice

- A so-called Stock-Back card that offers cash back rewards (in the form of stocks) when used at a partners

- A Roth or IRA account

- Life insurance (offered in cooperation with Avibra)

- A custodial account for children

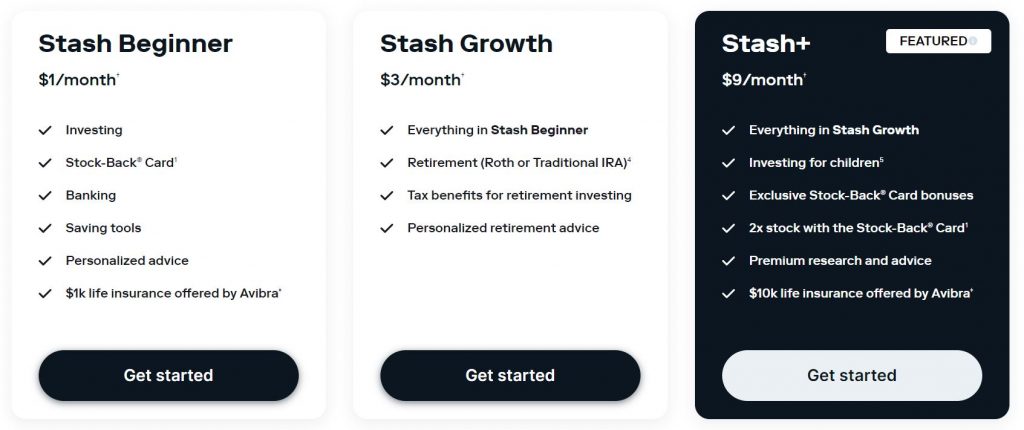

… and many more. These features and products are accessible via the various subscription plans that Stash offers. These are called Stash Beginner, Stash Growth, and Stash+.

During the signup process, Stash will ask various questions to determine a user's level of risk tolerance as well as financial goals. This allows them to offer tailored advice for activities such as budgeting and investing.

Users can then invest their money into thousands of stocks as well as dozens of themed ETFs, such as Match the Market or Foreign Heavyweights.

Stash is available on mobile, tablet, and smartphone devices on the Android as well as the iOS operating system.

Stash Company History

Stash, headquartered in New York, was founded in 2015 by Brandon Krieg (CEO), Ed Robinson, and David Ronick.

All 3 founders brought with them extensive experience in the areas of entrepreneurship and finance before launching Stash.

In 1998, a young Krieg joined an electronic trading company called EdgeTrade as their second hire. Over the next decade, he helped the business to grow, which ultimately led to a successful exit. In 2007, EdgeTrade was acquired by Knight Capital for a combined $59.5 million.

Krieg spent the next 5 years at Knight to help with the integration of EdgeTrade. Afterwards, he joined Macquarie where he was tasked with building up the firm's electronic trading desk function.

At Macquarie, he met Robinson, who joined the company back in 2005 as a trader. After stints in Sidney and London, Robinson moved to New York in 2013 where he became acquainted (and ultimately friends) with Krieg.

Two years into their working relationship, the pair decided to team up and launch a business of their own. David Ronick, who possessed years of experience in launching his own businesses (and even exited a few) joined them as the third co-founder.

The team spent the first few months just talking to people on the streets, asking them about anything related to money management, investing, or saving. The general sentiment was that the average person had an interest in investing their money but was simply overwhelmed with the supposed complexity that it entailed.

In February 2015, the trio started working on an iOS app that launched just 8 months later (a version on Android was released in early 2016). Over 50,000 people signed up for Stash prior to the launch.

The team cleverly built up hype by conducting interviews in various business- and finance-related publications which allowed them to gain early exposure.

To get a head start, the team raised a $1.5 million angel round from friends, family, their own savings, and a few investors.

At the time, Ronick was acting as the CEO of Stash but would end up leaving the firm within one year of the launch (and move to an advisory role). Today, he runs Minded, a delivery service for stress-relieving medications.

Despite the hiccup, interest in Stash remained unfazed. In 2016 alone, the startup was able to raise 3 different rounds of funding, netting them another $37.3 million. By that time, more than 300,000 had already subscribed to the service (with 10,000 more people joining every week).

Growth was based on a few key strategic twists the startup employed. First and foremost, Stash knew exactly how their customer demographic looked like. These were often millennials (with an average age of 29) that had an annual income of about $50,000.

Stash allowed its users to invest with as little as $5 (i.e. via fractional shares), a stark contrast to the hundreds or thousands that were needed when investing with traditional online brokers such as E*Trade or Charles Schwab.

Furthermore, Stash put an emphasis on educating its users (via tutorials, a guided onboarding process, as well as personalized advice) and making its investment products (here: ETFs) sound personal. For instance, ETFs would be called The Techie (for a tech-focused portfolio) or Clean & Green (stocks focused on renewable energy).

Lastly, Stash continued to expand its product offering by launching features tailored to its customer's needs. One example is the firm's savings feature which automatically puts money aside every month and invests that into stocks or ETFs. The team even drew inspiration from weight loss programs, as Krieg recalled in an interview with Forbes:

"We took our clues from weight loss programs. If you need to lose 30 pounds, how are you going to do that? Well you can't just lose 30 pounds overnight. You need to lose one pound and you need to be celebrated and feel great about it and then you need to lose two pounds. And so on and so on. The same thing goes with what we created called 'Auto Stash.' And now we have hundreds of thousands of people that are putting in on average $26.00 a week to save towards their goals."

That deep-level customer understanding allowed them to continue onboarding customers as well as raising money.

As a result of the coronavirus pandemic, Stash (along with other investment apps like Acorns or Robinhood) was able to exponentially grow its business. Customers would start using their government checks to invest excessive money into stocks, which fueled the firm's growth.

Today, Stash has close to $2 billion in assets under management (AUM). Over 5 million Americans are now registered on the firm's platform.

The company, furthermore, employs over 300 people in 3 offices across the United States and United Kingdom.

How Does Stash Make Money?

Stash makes money via subscriptions, referral fees from its cashback program, payment for order flow, as well as returns on the funds that card owners hold.

Let's dive into each of these revenue streams in more detail below.

Subscription

As highlighted above, Stash offers 3 different subscription plans that it charges on a monthly basis. These include Stash Beginner, Stash Growth, and Stash+.

Each tier offers access to a set of different features, such as personalized investment or retirement advice, custodian accounts, exclusive cashback rewards, and many more.

Acorns, the firm's closest competitor in terms of target users, offers similar plans. Meanwhile, robo advisors like Betterment or Wealthfront, albeit going after more affluent customers, choose to charge management fees instead of offering subscriptions.

Their fees range anywhere between 0.25 percent to 0.40 percent, depending on investment volume. In contrast, Stash users on the Beginner plan (= $1) would need to invest between $250 to $400 (0.25 percent) every month to get the same rates.

Cashback

Stash offers cashback rewards via the firm's Stock-Back card. Whenever you use the debit card to pay at a partner shop (such as Costco or Netflix), a percentage of the purchase price is used to automatically buy fractions of that firm's stock.

Users can earn up to 5 percent in stock rewards (with the average being 0.125 percent). For instance, if a user buys something at Amazon (another partner) for $100, then Stash will invest $5 of that into Amazon stock.

Just like with any other reward program, Stash will make money every time a user pays with the Stock-Back card. The company then receives a fraction of the reward in exchange for encouraging users to shop at the partner's store.

Payment For Order Flow

Another income source, yet sightly controversial, is payment for order flow. This method is used by almost any modern-day online brokerage and oftentimes represents a significant portion of their revenue.

Whenever a user places a stock order on Stash's platform, that order is then sent to a so-called market maker who compensates the brokerage (Stash, in this case) in exchange for bringing in deal flow.

These market makers oftentimes provide better offers, which allows them to compete with other stock exchanges (like the NASDAQ). Stash does not disclose which market makers it works together with.

The market maker then tries to turn a profit on the so-called bid-ask spread (or turn), which is the delta between the quoted rates for an instant sale (bid) and instantaneous buy (ask). Market makers essentially run an arbitrage business. Trades are algorithmically executed (without human involvement), which enables them to facilitate thousands upon thousands of trades at any given time.

In the past, the practice of transacting with market makers has often been heavily criticized by consumer advocate groups and financial regulators alike. First, the process itself (due to the automatic execution) often lacks any form of transparency.

Second, trades are executed in a matter of milliseconds, which can heavily contribute to market volatility. Lastly, retail investors may not always receive the best price on the execution.

To that extent, trading app Robinhood, in December 2020, has settled with the SEC for $65 million for allegedly deceiving its customers (without admitting any wrongdoing). The SEC claimed that the order flow payments were executed at a price point that was inferior to other brokerage firms.

Interest On Cash

Stash, just like any normal bank, uses the cash residing on user accounts to lend it out to other institutions, such as said banks.

They then collect interest from these institutions (also called Net Interest Margin). For 2019, according to Statista, net interest margin for all U.S. banks was equal to 3.35 percent.

Stash Funding, Valuation & Revenue

According to Crunchbase, Stash has raised a total of $427.4 million across 10 rounds of venture capital funding.

Notable investors include the likes of Breyer Capital, Union Square Ventures, T. Rowe Invest, LendingTree, and more.

The last time Stash disclosed its valuation was during the firm's Series F round (announced in April 2020). At the time, Stash was valued at $800 million – a valuation it has most likely surpassed (it raised another round in January 2021).

As a private company, Stash is not obligated to share any revenue or profit figures with the public. The firm, in all likeliness, continues to lose money in an effort to expand its business.

How To Make Money From Stash

Source: https://productmint.com/stash-invest-business-model-how-does-stash-invest-make-money/

Posted by: crowesuccionoth.blogspot.com

0 Response to "How To Make Money From Stash"

Post a Comment